Contact Us

Website Disclosure Information

INTRODUCTION TO LUNA FINANCIAL SERVICES

At Luna Financial Services (Luna Financial), we want to ensure you make the most of your finances throughout your lifetime, so you can really enjoy your life. Building wealth requires time, patience and expertise you can rely on. And reliability is this the cornerstone of everything we do. Whatever your circumstances, Luna Financial can help you set and achieve your wealth and lifestyle goals.

The purpose of the Website Disclosure Information (WDI) is to help you make informed decision about the services we offer and whether they are suited appropriately to meet your needs.

The Licensee Insight Investment Partners, its employees and Corporate Authorised Representatives of Luna Financial Services (including any employees of a related body corporate) are collectively referred to as “us, we, our” throughout this WDI. Insight Investment Partners has approved the distribution of this Website Disclosure Information by your Luna Financial Services Adviser. This Website Disclosure Information was prepared on 19 December 2024. This Website Disclosure Statement should be read with the Adviser Profile document dated 19 December 2024.

This Website Disclosure Information (‘WDI’) helps you understand and decide if you wish to use the financial services we are able to offer you. It provides important information on how to engage with one of our advisers and contains the following important information designed to help you decide on whether to use our services.

The financial services that we offer as a Corporate Authorised Representative of Insight Investment Partners;

▪ Insight Investment Partners as the holder of an AFSL;

▪ the services that Insight Investment Partners offers;

▪ the process we follow to provide financial services;

▪ how we, our associates, and Insight Investment Partners are paid;

▪ any arrangements which may influence our advice to you;

▪ how we and Insight Investment Partners protect your privacy;

▪ who to contact if you were to have a compliant or if you are not satisfied with the services provided; and

▪ our Privacy Policy and information we may request from your in order provide you with advice and services which are appropriate to you.

LACK OF INDEPENDENCE

Insight Investment Partners is not able to describe itself as being independent, impartial or unbiased because we:

• receive commissions for the advice we provide on life risk insurance products; and

• have an approved product list which limits the range of products we or our representatives can recommend when providing advice to you;

Should we provide you with personal financial product advice, and you are a retail client, you will receive a Statement of Advice (SOA). The SOA is a record of our recommendations; the basis on which it is given, and information about commissions, fees, charges and any associations that may have influenced the provision of such advice.

Where further advice is provided we may not provide an SOA where the relevant circumstances and basis for advice have not significantly changed from the original SOA. However, we will provide upon request what is known as a Record of Advice (ROA). You can request this at any time from your adviser or by emailing or writing to us.

Occasionally we provide general advice. This is where we may express an opinion or recommendation influencing you in making a decision in relation to a financial product, but where we HAVE NOT considered your personal objectives, financial situation or needs. If we provide you with general advice, we will provide you with a warning that the advice may not be appropriate to your needs, financial situation or objectives. Additionally, we will provide you with an applicable Product Disclosure Statement (’PDS’) (if one is available) which you should read before making a decision that the product is right for you.

In the event we make a recommendation to you to acquire a particular financial product (other than listed securities) or offer to issue or arrange the issue of a financial product, we will also provide a Product Disclosure Statement (PDS). The PDS contains information about the risks, benefits, features and fees payable in respect of the product.

The Licensee has arrangements in place to maintain professional indemnity insurance. This insurance satisfies the requirements under section 912B of the Act.

Please retain this Website Disclosure Information for your reference and any future dealings with us. We may also add documents at a later date which will also form part of this WDI, and these should be read together with the WDI. These documents will include the word ‘WDI’ in the heading.

ABOUT LUNA FINANCIAL SERVICES

Luna Financial Services Pty Limited (ABN 83 651 409 871), trading as Luna Financial, is a Corporate Authorised Representative of Insight Investment Partners Pty Ltd (AFSL 368175).Karen Truman, Director of Luna Financial, is an Authorised Representative of Luna Financial Services (ASIC Representative Number 1008604), and is authorised to provide financial services on its behalf. Christopher Fellas is an Authorised Representative of Luna Financial Services Pty Ltd (ASIC Representative Number 339065).

ABOUT INSIGHT INVESTMENT PARTNERS

Insight Investment Partners holds an Australian Financial Service License (AFSL No. 36875) issued by the Australian Securities and Investments Commission.

As the holder of an AFSL, Insight Investment Partners is responsible for the financial services we provide you. Insight Investment Partners acts on its own behalf when these financial services are provided to you. In relation to the financial services offered in this WDI, Insight Investment Partners, as the holder of an AFSL, does not act on behalf of any other person or licensee. Insight Investment Partners is only responsible for the services offered in the WDI.

The law requires Insight Investment Partners to have arrangements in place to compensate certain persons for loss or damage they suffer from certain breaches of the Corporations Act by Insight Investment Partners and/or its Authorised Representatives. Insight Investment partners has an internal compensation arrangements as well as professional indemnity insurance that satisfy these requirements.

WHO WILL BE PROVIDING SERVICES TO YOU?

The Licensee

The Licensee is the authorising licensee for the financial services provided to you and is responsible for those services and is the providing entity.

The Licensee authorises, and is also responsible for, the content and distribution of this WDI.

The Licensee’s contact details are as follows:

Licensee name: Insight Investment Partners

AFSL number: 368175

Address: The Commons, 39 Martin Place, Sydney, NSW 2000

Website: www.iipdealergroup.com.au

www.iipdealergroup.com.au

Phone: 02 9181 3431

Email: [email protected]

The Corporate Authorised Representatives are:

Name: Karen Truman

ASIC AR number: 1008604

Phone: 0448123876

Email: [email protected]

Karen Truman is a Professional Partner of the Financial Advice Associate Australian (FAAA); we are fully committed to the FAAA’s Code of Ethics and Rules of Professional Conduct.

Name: Christopher Fellas

ASIC AR number: 339065

Phone: 0400555225

Email: [email protected]

You can provide instructions to us by contacting us using the contact details above.

The Licensee and the Authorised Representatives listed in this WDI can act on your behalf when we provide financial services to you.

ADVISER PROFILE - CHRISTOPHER FELLAS

This document is the Adviser Profile of the Financial Services Guide (FSG) dated 29 July 2022 and should be read together with the FSG.

IIP Asset Management is authorised to provide the financial services described in this FSG by:

Licensee name: Insight Investment Partners

AFSL number: 368175

Address: Level 10, 60 York Street, SYDNEY NSW 2000

Website: www.iipdealergroup.com.au

Phone: 02 9181 3431

Email: [email protected]

WHO IS YOUR FINANCIAL ADVISER?

Your Financial Adviser is Christopher Fellas. Christopher Fellas’ Authorised Representative number is

339065.

You can provide instructions to me by [email protected].

LACK OF INDEPENDENCE

Insight Investment Partners is not able to describe itself as being independent, impartial or

unbiased because we:

• receive commissions for the advice we provide on life risk insurance products; and

• have an approved product list which limits the range of products we or our

representatives can recommend when providing advice to you;

WHAT EXPERIENCE DOES THE FINANCIAL ADVISER HAVE?

Experienced Chief Executive Officer with a demonstrated history of working in the financial services

and accounting industries. Founding Partner in Insight Management Partners. With experience in

company structures and funding solutions, risk management, entrepreneurship, accounting, Market

Risk, and Asset Management. Strong business development professional with 30 years experience.

Bachelor's degree Accounting and Finance, currently studying Masters of FinTech UNSW.

WHAT QUALIFICATIONS AND PROFESSIONAL MEMBERSHIPS DOES YOUR FINANCIAL ADVISER HAVE?

I am a Bachelor of Accounting and Finance, Diploma of Financial Services and Masters of FinTech

UNSW

WHAT AREAS IS YOUR FINANCIAL ADVISER AUTHORISED TO PROVIDE ADVICE ON?

I am authorised to provide financial services, including advice or services in the following areas:

• Deposit and Payment Products

• Derivatives

• Government Debentures, Stocks or Bonds

• Investment Life Insurance Products

Insight Investment Partners is not able to describe itself as being independent, impartial or

unbiased because we:

• receive commissions for the advice we provide on life risk insurance products; and

• have an approved product list which limits the range of products we or our

representatives can recommend when providing advice to you;

• Life Risk Insurance Products

• Managed Investment Schemes, including IDPS

• Retirement Savings Account Products

• Securities

• Superannuation

• Self Managed Super Funds

• Standard Margin Lending Facility

HOW WILL YOUR FINANCIAL ADVISER BE PAID FOR THE SERVICES PROVIDED?

I receive a salary as a Director of IIP Asset Management. and may also be awarded an annual bonus.

Bonuses will depend on several factors including:

• company performance;

• professionalism and adherence to compliance procedures; and

• team performance.

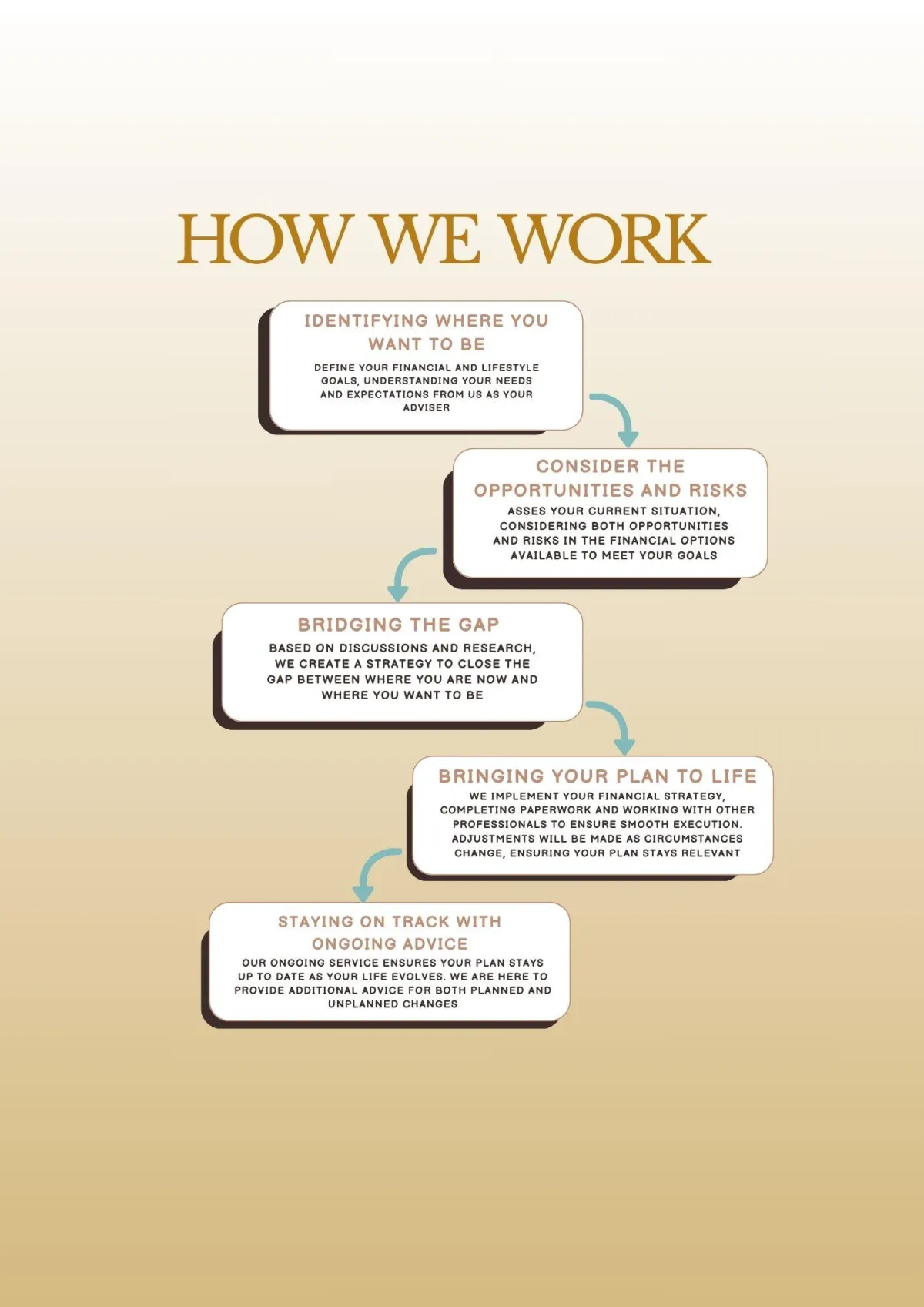

OUR FINANCIAL PLANNING PROCESS

We follow a defined financial planning process so that you can achieve all the benefits of financial planning advice. Of course, everyone is different, with different circumstances, needs and goals. We treat every client as an individual but by following a defined process, you will know what to expect. The initial advice process covers our first appointment all the way through to the implementation of your financial plan.

FINANCIAL SERVICES WE OFFER

Your adviser at Luna Financial is authorised by Insight Investment Partners to provide advisory services designed to help you create, manage and protect your wealth. We are able to advise on the below strategies and provide financial product advice and to deal in wide range of products.

Strategies

Savings with wealth and creation strategies

Investment planning

Superannuation advice including self-managed super funds

Pre-retirement and retirement planning

Social security entitlements and Centrelink planning

Risk and insurance analysis

Business succession planning

Gearing strategies

Debt management

Direct Equities

Estate planning

Products

Deposit products

Superannuation and retirement income streams

Direct fixed interest

Direct equities

Retail and wholesale managed investment schemes

Socially responsible investments

Managed investment schemes including investor directed portfolio services

Life insurance products (excluding general insurance)

*Although we provide estate planning advice as part of or incidental to the provision of financial planning advice, we can arrange to refer you to an estate planning specialist who deal in these professional services, were required.

Approved Products

Luna Financial Services receives insights from Insight Investment Partners' Investment Committee, which includes both internal and external experts. These experts conduct thorough financial product research and establish a single house view on financial markets. We also perform due diligence on external research providers to carefully select and maintain an extensive list of approved products. These products are available for recommendation and detailed in our Approved Product List (APL).

While we maintain a single house view on financial markets, we only recommend products that are suitable for your individual objectives, financial situation, and needs. Our recommendations will consider your existing financial products where necessary to help meet your goals.

Transaction services

It is important to understand that, in these circumstances, we will generally ask you to confirm your instructions in writing and sign a letter acknowledging that you have declined our offer of advice and understand the risks of the transaction. A copy of this letter will be provided for your records.

Documents you may receive

When your adviser provides personal financial advice to you, you may receive one or more of the following documents:

Letter of Engagement

Following our initial consultation, we will provide you with a Letter of Engagement. This document outlines the agreed scope of advice and details the initial advice fee and ongoing adviser service fees before you commit to engaging our services.

Statement of Advice (SOA) and Record of Advice (ROA)

The SOA will outline advice tailored to your specific circumstances, summarizing your goals, and the strategies and financial products we recommend to achieve them. It will also include detailed information about the fees, costs, and other benefits we receive as a result of the advice provided. If your personal circumstances have not significantly changed, further advice may be delivered through a ROA. We will keep a record of any further advice for seven years, and you may request a copy by contacting our office.

Annual Service Agreement (ASA) or Ongoing Services Agreement (OSA)

The Annual Service Agreement or Ongoing Services Agreement outlines the services we will provide on an ongoing basis, as well as the associated costs. It specifies the review services we offer, the frequency of these reviews, the cost, payment method, and how the agreement can be terminated.

Product Disclosure Statement (PDS) or Investor Directed Portfolio Service (IDPS) Guide

If we recommend or arrange a financial product for you, we will provide a relevant Product Disclosure Statement (PDS) or Investor Directed Portfolio Service (IDPS) guide. These documents explain key features of the recommended product, including its benefits, risks, and the costs charged by the product provider for managing your investment or insurance. It's important to review any warnings in the PDS, IDPS guide, or your financial plan before making a decision.

Fee Disclosure Statement (FDS) and Ongoing Services Renewal Notice

If you enter into an Ongoing Fee Arrangement with your adviser for more than 12 months, you will receive a Fee Disclosure Statement (FDS). The FDS will outline the services you were entitled to, the services you actually received, and the fees paid during the period.

We will meet periodically to review your financial circumstances if you agree to an ongoing advice service arrangement with a regular review component. This will be documented in your Ongoing Service Agreement and/or SOA.

LUNA FINANCIAL'S REMUNERATION ARRANGEMENTS

Under section 923A of the Corporations Act, Luna Financial is not considered independent, as we are entitled to receive remuneration, including commissions from insurance products, for the financial services we provide to our clients.

We believe the services we offer are valuable, and the remuneration we receive is a fair reward for our expertise and skills. Our advisers are authorised to provide a wide range of strategic advice and recommend products from Insight Investment Partners

The following outlines the remuneration we may receive as a result of the advice services provided to you.

Initial Fees for Our Advice

We may charge fees for the preparation, presentation, and implementation of our advice. These fees are based on your individual circumstances, the complexity of your situation, and the time required to prepare your personalised financial plan.

We will discuss both the upfront and ongoing fees with you before preparing the Letter of Engagement, and before proceeding with further research and preparation of your financial plan.

Annual Service Agreements and Ongoing Advice Service Fees

The Annual Service Agreement (12-month fixed term agreement) or ongoing advice service fee covers the cost of regularly reviewing the strategies and products managed on your behalf, as outlined in our advice.

Regular reviews allow you to take advantage of new opportunities, adjust your financial plan to meet changing goals or legislation, and help you stay on track to achieve your financial objectives.

The proposed annual service or ongoing advice fee structure will be detailed in your Letter of Engagement before any work begins, ensuring transparency regarding costs.

An estimate of the annual ongoing service fees will be included in your Statement of Advice, and we will seek your approval via the accompanying Ongoing Services Agreement.

The ongoing advice service fee can be calculated either as a fixed dollar amount or as a percentage of your investments. This fee may increase each year in line with the Consumer Price Index (CPI), or by a fixed amount or percentage annually. You will be informed if the fee will increase due to CPI adjustments.

Payment Methods

Our fees can be either invoiced directly to you, deducted from your investments, or a combination of both. When fees are deducted from your investments, they are typically referred to as the Adviser Service Fee. In most cases, you will be able to choose the payment method that works best for you. We will discuss and agree on the method of payment before providing any financial services.

Commission & Brokerage

If you acquire a financial product through us, we may receive payments in the form of initial and/or ongoing commissions from the product providers. These commissions are included in the fees and premiums you pay for the product. In some instances, we may agree to rebate some or all of these commissions to you.

Life Insurance Products

Luna Financial may receive initial and ongoing commissions from insurance providers. These commissions are paid by the insurance company that issues the product we recommend to you and are factored into the cost of the product. The commissions are based on the policy cost, which includes the premiums you pay and may also include other related fees.

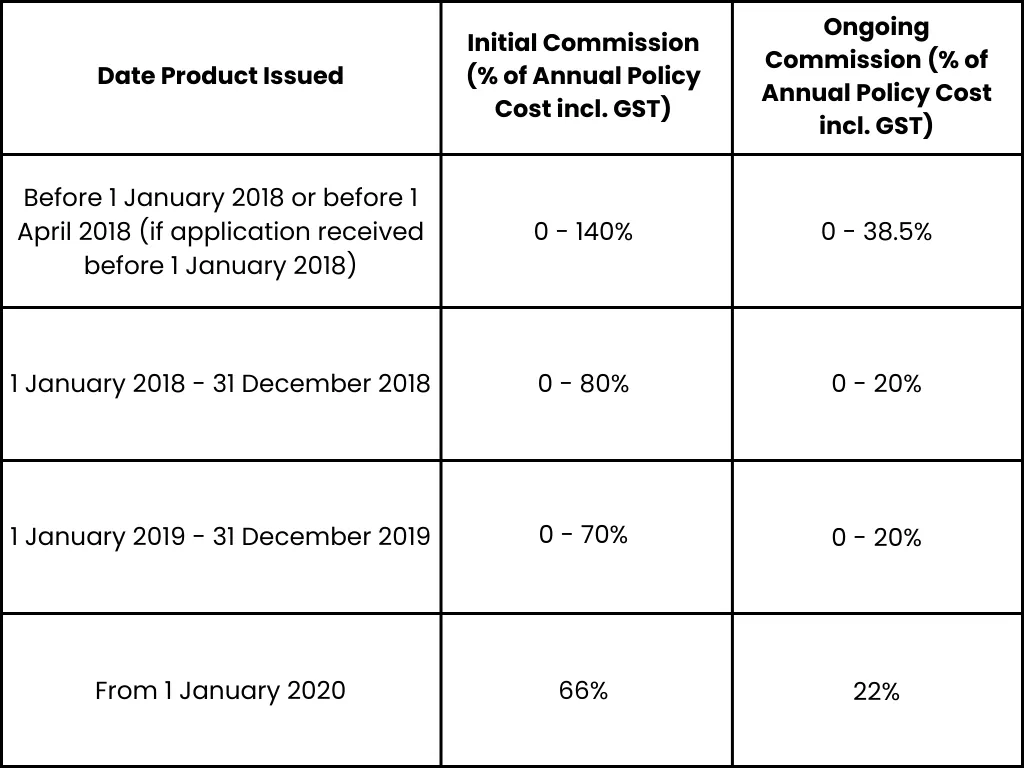

The initial commission is paid to Luna Financial in the first year by the product issuer, while ongoing commissions are paid in subsequent years. If you increase the level of your cover, we may receive initial and ongoing commissions on the increased portion of your policy cost. The ongoing commission for an increase is only paid from the first anniversary of the increase. The maximum commissions that Insight Investment Partners may receive are outlined in the table below:

Note: We may receive commission rates that are higher than those outlined in the table above if:

Your policy was issued before 1 January 2018, and you exercise an option or apply for additional cover after 1 January 2018, or;

Your policy was issued before 1 January 2018 and is replaced after that date to correct an administrative error.

Other Commissions

We generally do not receive commissions for financial products other than life insurance products. Commissions on investment products may only be payable in specific circumstances where an arrangement with the product provider was in place prior to 1 July 2013.

Brokerage

We may receive up to 100% of any brokerage fees charged for executing share trades. These fees may range between 0% to 1.10% (inclusive of GST), with a minimum charge of $110 (inclusive of GST) per transaction. For example, on an investment of $100,000 in direct shares, a brokerage rate of 1.10% would result in a fee of $1,100 (inclusive of GST) paid to Insight Investment Partners.

Margin Lending Products

If we arrange or increase a margin loan for you, Insight Investment Partners may receive ongoing commission payments from the margin loan provider. Commissions on margin lending products are only payable under the following circumstances:

An arrangement existed as of 1 July 2013, or;

You entered into a margin lending product arrangement before 1 July 2014, in which case commissions may be payable if Insight Investment Partners had an existing arrangement with the provider before 1 July 2013.

These commissions typically range between 0% and 2% per annum of your loan balance.

Example

If we recommend you borrow $10,000 through a margin loan with an ongoing commission rate of 0.5% per annum, Insight Investment Partners would receive $50 each year, assuming your loan balance remains unchanged. You may request additional details about how we are remunerated at any time after receiving this document.

How Are We Remunerated?

Directors and employees of Insight Investment Partners are paid a salary and may be eligible for annual bonuses, which are based on:

Company performance

Professionalism and adherence to compliance procedures

Team performance

You may request additional information about remuneration within a reasonable time after receiving this document and before financial services are provided. If remuneration is calculable when personal advice is given, it will be disclosed at that time or as soon as possible thereafter. If it is not calculable, we will provide a statement explaining how it is calculated when the advice is given.

Adviser Relationships or Associations

Your adviser may receive non-cash benefits valued at less than $300, which can include gifts, business lunches, tickets to events, or participation in industry events such as conferences or professional development sessions. Should your adviser receive such benefits, they will be recorded in our benefits register, which is available upon request.

OUR COMPLAINTS HANDLING PROCEDURE AND HOW TO ACCESS THEM

We are committed to meeting if not exceeding our clients’ expectations whenever possible. Insight Investment Partners endeavours to provide you with quality financial advice. If you have a complaint or concern about the service provided to you, we encourage you to take the following steps:

1. Contact your adviser and tell your adviser about your complaint.

2. If your complaint is not satisfactorily satisfied in five business days, please email or write your complaint to [email protected]

3. If your complaint is not satisfactorily resolved within 30 business days, you have the right to contact the Australian Financial Complaints Authority (AFCA).

AFCA independently and impartially resolves disputes between consumers, including some small businesses, and participating financial services providers. The Australian Financial Complaints Authority can be contacted on:

Toll Free Telephone: 1800 931 678 GPO Box 3, Melbourne Vic 3001

Website: www.afca.org.au

Fax: (03) 9613 6399

Email: [email protected]

4. The Australian Securities and Investments Commission (ASIC) serves as Australia's regulator for corporate, markets, and financial services. ASIC plays a crucial role in upholding Australia’s economic reputation by ensuring that financial markets are fair and transparent, supported by informed investors and consumers. The Commission is committed to protecting consumers from misleading, deceptive, and unconscionable conduct related to all financial products and services. You can contact ASIC at:

Toll-Free Telephone: 1300 300 630

Mail: GPO Box 9827, Your Capital City

or

PO Box 4000, Gippsland Mail Centre, VIC 3841

Website: www.asic.gov.au

Compensation Arrangements

Insight Investment Partners maintains a professional indemnity insurance policy that meets legislative requirements. This policy, subject to its terms and conditions, provides coverage for claims arising from professional services rendered by Insight Investment Partners. It covers claims against us due to the actions of our representatives and employees, including those who are no longer with us but were employed at the time of the relevant conduct.

ADVISER PROFILE - KAREN TRUMAN

This document is the Adviser Profile of the Website Disclosure Information (WDI) dated 30 September 2024.

Luna Financial Services is authorised to provide the financial services described in this WDI by:

Licensee name: Insight Investment Partners

AFSL number: 368175

Address: Level 10, 60 York Street, SYDNEY NSW 2000

Website: www.iipdealergroup.com.au

Phone: 02 9181 3431

Email: [email protected]

Who is your Financial Adviser?

Your Financial Adviser is Karen Truman. Karen Truman is a Corporate Authorised (ASIC CAR Representative number is 1008604).

You can provide instructions to me by [email protected]

Lack of Independence

Insight Investment Partners is not able to describe itself as being independent, impartial or unbiased because we:

• receive commissions for the advice we provide on life risk insurance products; and

• have an approved product list which limits the range of products we or our representatives can recommend when providing advice to you;

What experience does your financial adviser have?

Karen brings together her expertise in financial strategy and a passion for quality client management. With a long background in financial planning, Karen is ideally placed to provide clients with quality financial advice.

“I have a huge fascination with financial markets, and I love being able to help people, so I really enjoy working at that intersection of people and finance.

When I began working in the industry, I realised that this was such valuable information that everyone should have. And I really enjoy helping people by sharing that knowledge, advising clients on best strategies and helping them achieve long-term financial goals.”

Karen’s financial expertise stems from an initial degree in Business Analysis, reinforced with further studies in financial planning and financial business management. Since her first role with a boutique wealth management company, Karen has enjoyed building long-term relationships with clients – and solving problems.

“I enjoy meeting clients, finding out what they want and getting stuck into strategy. And then when I can retain those client relationships over time and see them reach their financial goals, it’s very satisfying.”

Education and Qualifications

▪ Certified Financial Planner ® - Financial Advice Association Australia (FAAA)

▪ Bachelor of Business Analysis – University of Waikato, New Zealand

▪ Advanced Diploma of Financial Planning – Kaplan Professional Australia

▪ Diploma of Financial Planning - Kaplan Professional Australia

▪ Certificate IV in Finance and Mortgage Broking – Kaplan Professional Australia

▪ Financial Adviser Exam – Financial Adviser Standard and Ethics Authority (FASEA)

▪ Ethics and Professionalism in Financial Advice – Kaplan Professional Australia

Memberships

▪ Certified Financial Planner® and member of the Financial Advice Association Australian (FAAA)

▪ Registered Tax (Financial) Adviser with the Tax Practitioners Board

Experience

▪ Karen has been providing financial advice to clients since 2015

What areas is your Financial Adviser authorised to provide advice on?

Karen Truman is authorised to provide financial services, including advice or services in the following areas:

▪ Deposit and Payment Products

▪ Government Debentures, Stocks or Bonds

▪ Investment Life Insurance Products

▪ Life Risk Insurance Products

▪ Managed Investment Schemes, including IDPS

▪ Retirement Savings Account Products

▪ Securities

▪ Superannuation

How will your financial adviser be paid for the services provided?

I receive a salary and profit share as a Director of Luna Financial Services Pty Ltd.

ASIC AR Number: 1008604

The Commons, 39 Martin Pl, Sydney NSW 2000

Luna Financial Services Pty Ltd ABN 83 651 409 871

Luna Financial Services is a Corporate Authorised representative under Insight Investment Partners Pty Ltd, holder of Australian Financial Services Licence 368175.

The information provided on this site is for illustrative and discussion purposes only. While every care has been taken in its preparation, any party seeking to rely on its content should make their own enquiries and research to ensure its relevance to their specific personal situation and circumstances. Please note that the information on this website is general in nature and does not consider your individual financial needs or objectives. It is recommended that you seek professional advice tailored to your personal circumstances before making any financial decisions.